Impact of 401(k) on Financial Assets

Data explanation

1991 Survey of Income and Program Participation

-

net_tfa — Net Total Financial Assets. Calculated as the sum of all liquid and interest-earning assets (IRA balances, 401(k) balances, checking accounts, U.S. savings bonds, other interest‐earning accounts, stocks, mutual funds, etc.) minus non‐mortgage debts.

-

e401 — 401(k) Eligibility Indicator. Equals 1 if the individual's employer offers a 401(k) plan; otherwise 0.

-

p401 — 401(k) Participation Indicator. Equals 1 if the individual participate in 401(k) plan; otherwise 0.

-

age — Age. Age of the individual in years.

-

inc — Annual Income. Annual income of the individual, measured in U.S. dollars for the year 1990.

-

educ — Years of Education. Number of completed years of formal education.

-

fsize — Family Size. Total number of persons living in the household.

-

marr — Marital Status. Equals 1 if the individual is married; otherwise 0.

-

twoearn — Two-Earner Household. Equals 1 if there are two wage earners in the household; otherwise 0.

-

db — Defined-Benefit Pension Plan. Equals 1 if the individual is covered by a defined-benefit pension plan; otherwise 0.

-

pira — IRA Participation. Equals 1 if the individual contributes to an Individual Retirement Account (IRA); otherwise 0.

-

hown — Home Ownership. Equals 1 if the household owns its home; 0 if renting.

We download it with fetch_401K function from doubleML.datasets

This dataset has a problem. confounders were measured in the same year as treatment and outcome, like they are demographic factors that do not change over time. So inference might still be biased.

/Users/ioannmartynov/miniconda3/envs/causalkit/lib/python3.14/site-packages/tqdm/auto.py:21: TqdmWarning: IProgress not found. Please update jupyter and ipywidgets. See https://ipywidgets.readthedocs.io/en/stable/user_install.html from .autonotebook import tqdm as notebook_tqdm

Index(['net_tfa', 'age', 'inc', 'fsize', 'educ', 'db', 'marr', 'twoearn', 'p401', 'pira', 'hown'], dtype='object')

EDA

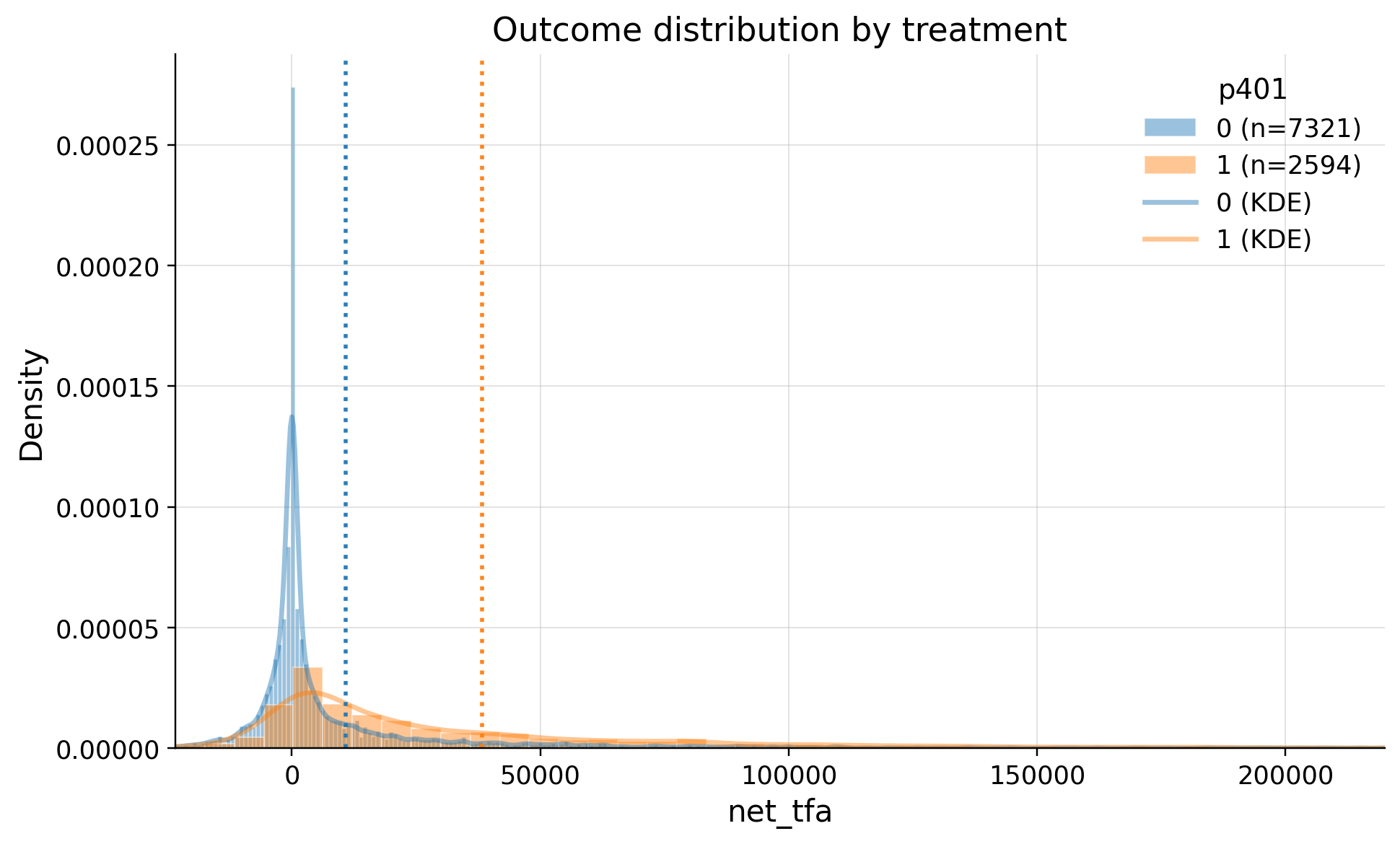

| treatment | count | mean | std | min | p10 | p25 | median | p75 | p90 | max | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 7321 | 10890.477539 | 55256.829173 | -502302.0 | -5427.0 | -1184.0 | 200.0 | 7399.0 | 33500.0 | 1462115.0 |

| 1 | 1 | 2594 | 38262.058594 | 79087.535303 | -283356.0 | -1300.0 | 3000.0 | 15249.0 | 45985.5 | 98887.4 | 1536798.0 |

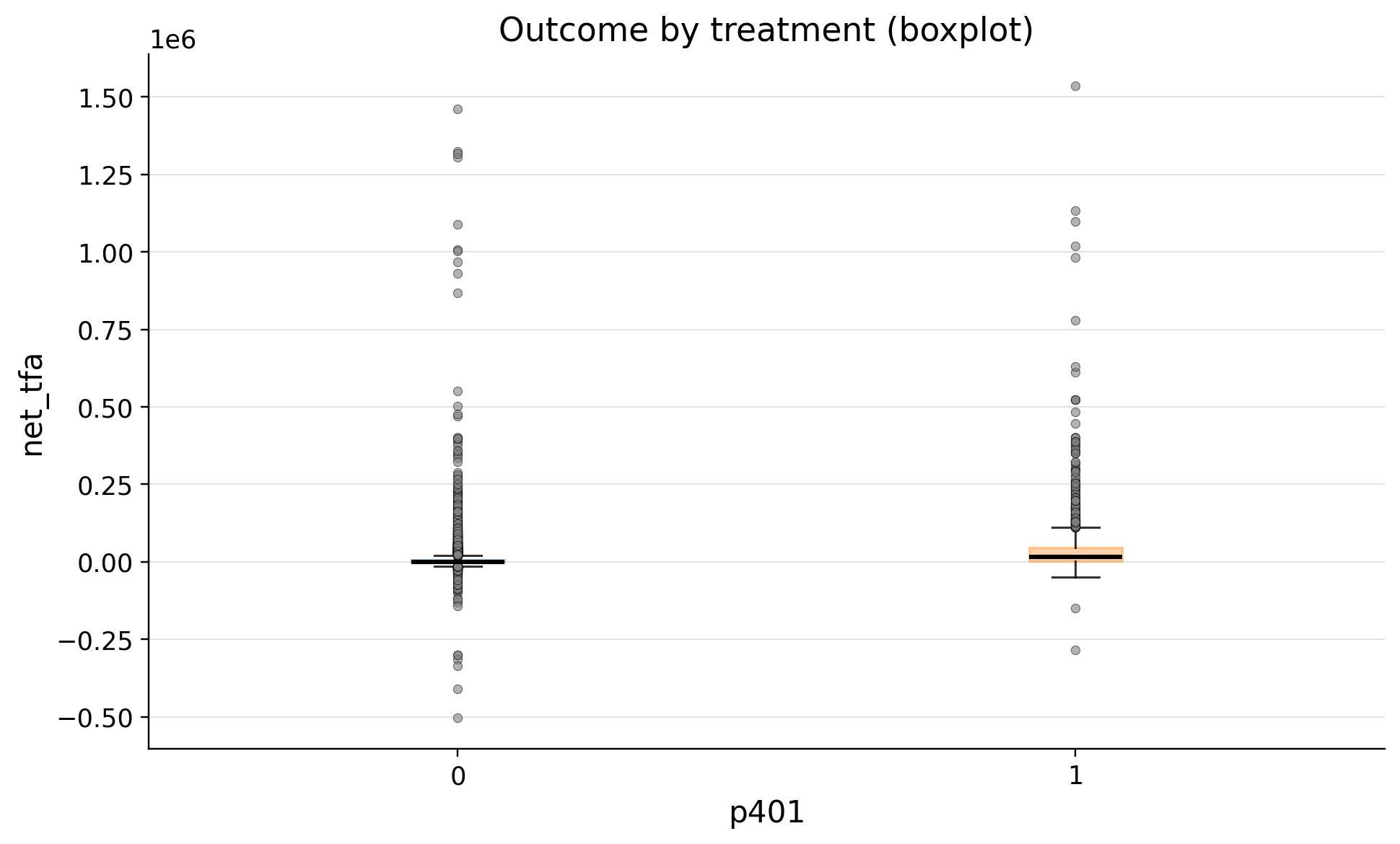

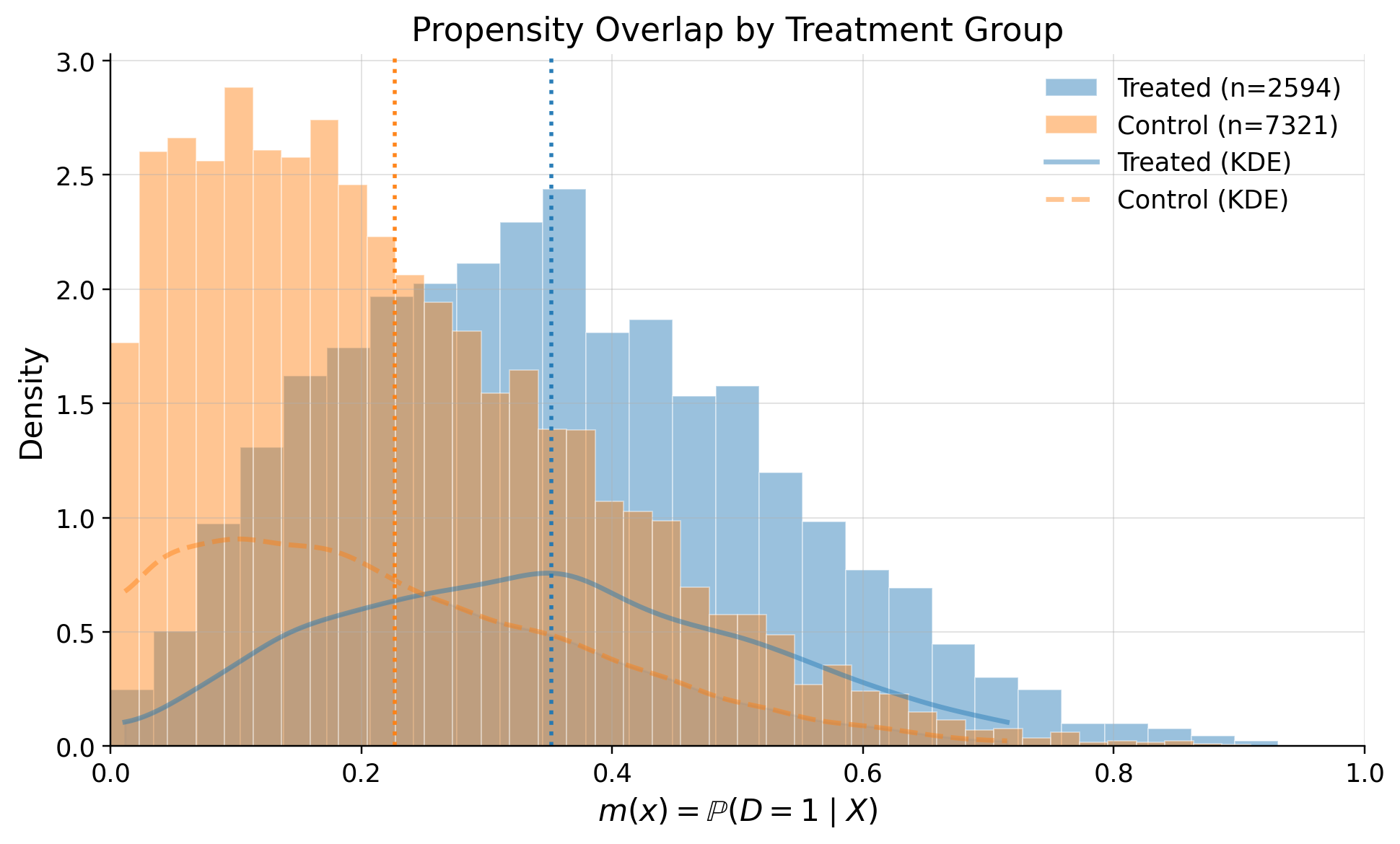

Participants’ average net worth is ≈28k higher, but this gap cannot be causally attributed solely to participation. The classes are imbalanced—only 26% are treated.

Our outcome has large right tail

| treatment | n | outlier_count | outlier_rate | lower_bound | upper_bound | has_outliers | method | tail | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 7321 | 1292 | 0.176479 | -14058.50 | 20273.50 | True | iqr | both |

| 1 | 1 | 2594 | 212 | 0.081727 | -61478.25 | 110463.75 | True | iqr | both |

| confounders | mean_d_0 | mean_d_1 | abs_diff | smd | ks_pvalue | |

|---|---|---|---|---|---|---|

| 0 | inc | 32889.802486 | 49366.975713 | 16477.173227 | 0.662197 | 0.00000 |

| 1 | hown | 0.589127 | 0.765227 | 0.176100 | 0.383456 | 0.00000 |

| 2 | pira | 0.200246 | 0.360447 | 0.160201 | 0.362421 | 0.00000 |

| 3 | db | 0.228248 | 0.391673 | 0.163426 | 0.358968 | 0.00000 |

| 4 | twoearn | 0.337659 | 0.502699 | 0.165040 | 0.339096 | 0.00000 |

| 5 | educ | 12.991121 | 13.813416 | 0.822294 | 0.299061 | 0.00000 |

| 6 | marr | 0.574512 | 0.690439 | 0.115928 | 0.242175 | 0.00000 |

| 7 | age | 40.900970 | 41.509638 | 0.608668 | 0.060108 | 0.00000 |

| 8 | fsize | 2.848108 | 2.915960 | 0.067852 | 0.044731 | 0.00076 |

Treatment and control are unbalanced on all confounders except age and fsize; nonetheless, we retain age and fsize in the model to gain efficiency

Inference

| value | |

|---|---|

| field | |

| estimand | ATE |

| model | IRM |

| value | 11027.1737 (ci_abs: 8241.3361, 13813.0113) |

| value_relative | 79.0032 (ci_rel: 53.3308, 104.6757) |

| alpha | 0.0500 |

| p_value | 0.0000 |

| is_significant | True |

| n_treated | 2594 |

| n_control | 7321 |

| treatment_mean | 38262.0605 |

| control_mean | 10890.4771 |

| time | 2026-02-20 |

Average Treatment Effect is significant and equals 12486.5221 (ci_abs: 9791.0517, 15181.9924)

Refutation

Unconfoundedness

| metric | value | flag | |

|---|---|---|---|

| 0 | balance_max_smd | 0.071103 | GREEN |

| 1 | balance_frac_violations | 0.000000 | GREEN |

Sensitivity

| r2_y | r2_d | rho | theta_long | theta_short | delta | |

|---|---|---|---|---|---|---|

| p401 | 0.000038 | 9.626565e-08 | 1.0 | 11027.17369 | 14961.333165 | -3934.159474 |

{'theta': 11027.173690133526, 'se': 1421.3718379696486, 'alpha': 0.05, 'z': 1.959963984540054, 'H0': 0.0, 'sampling_ci': (8241.336079073513, 13813.01130119354), 'theta_bounds_cofounding': (11026.878096998567, 11027.469283268485), 'bias_aware_ci': (8241.052409910035, 13813.318820768469), 'max_bias_base': 154546.29526314724, 'max_bias': 0.29559313495817796, 'bound_width': 0.29559313495817796, 'sigma2': 3792734186.778151, 'nu2': 6.29745091623553, 'rv': 0.06659988318083149, 'rva': 0.05062630379913903, 'params': {'r2_y': 3.8e-05, 'r2_d': 9.626565e-08, 'rho': 1.0, 'use_signed_rr': False}}

SUTVA

1.) Are your clients independent (i). Outcome of ones do not depend on others? 2.) Are all clients have full window to measure metrics? 3.) Do you measure confounders before treatment and outcome after? 4.) Do you have a consistent label of treatment, such as if a person does not receive a treatment, he has a label 0?

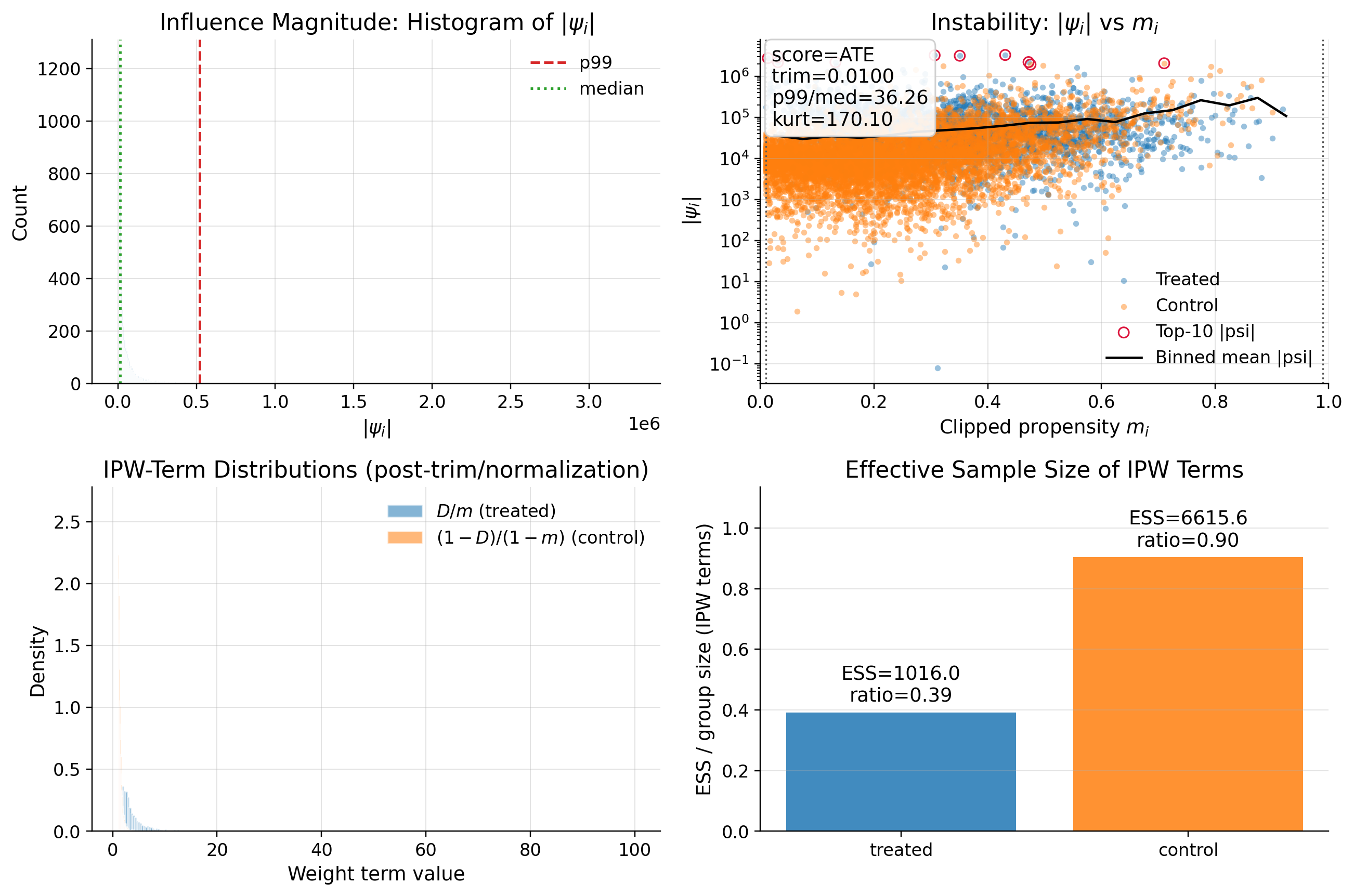

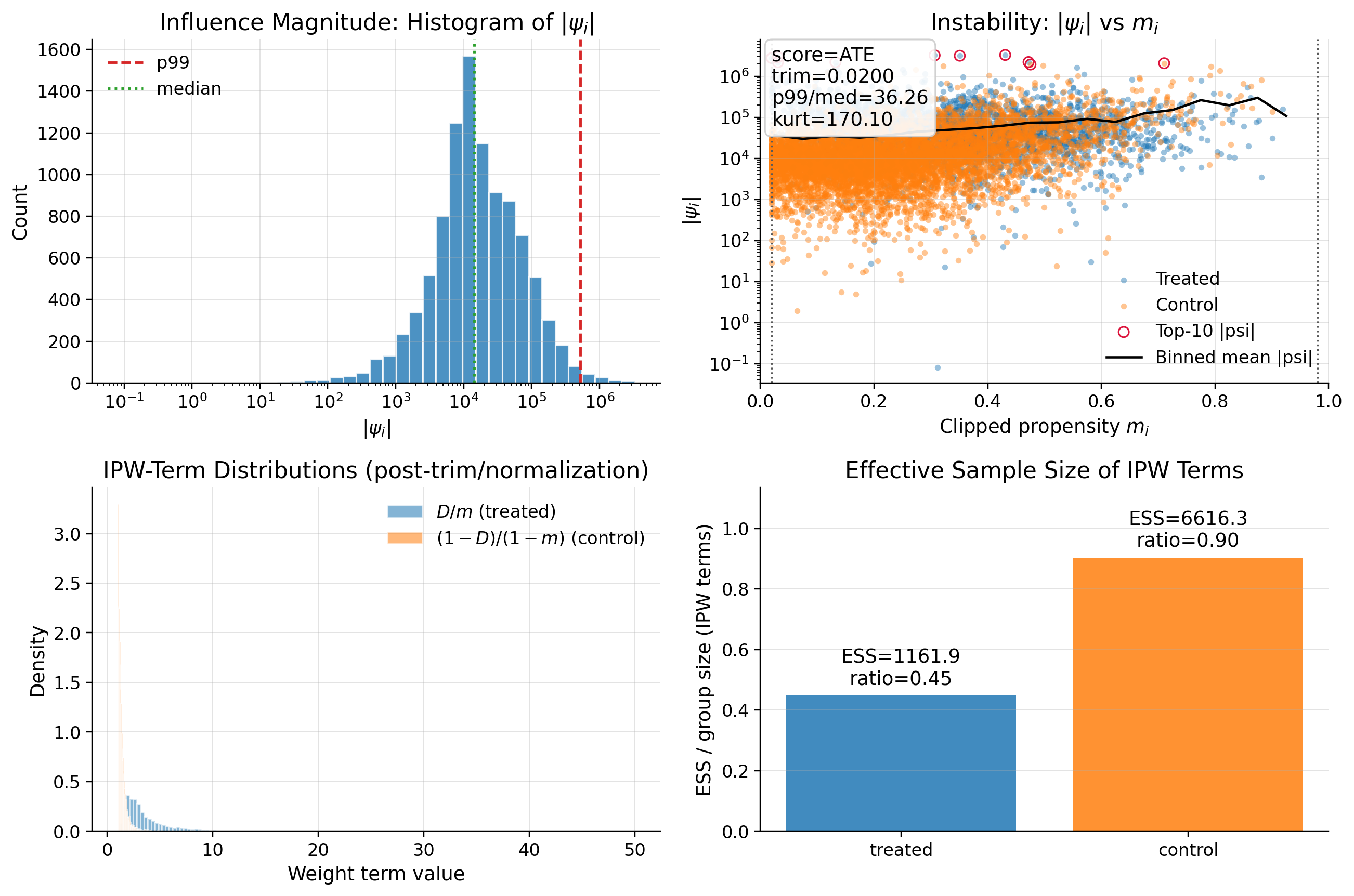

Score

| metric | value | flag | |

|---|---|---|---|

| 0 | se_plugin | 1.421372e+03 | NA |

| 1 | psi_p99_over_med | 3.625835e+01 | RED |

| 2 | psi_kurtosis | 1.700952e+02 | RED |

| 3 | max_|t|_g1 | 3.709872e+00 | YELLOW |

| 4 | max_|t|_g0 | 1.989905e+00 | GREEN |

| 5 | max_|t|_m | 2.116322e+00 | YELLOW |

| 6 | oos_tstat_fold | 2.643408e-16 | GREEN |

| 7 | oos_tstat_strict | 1.982299e-16 | GREEN |

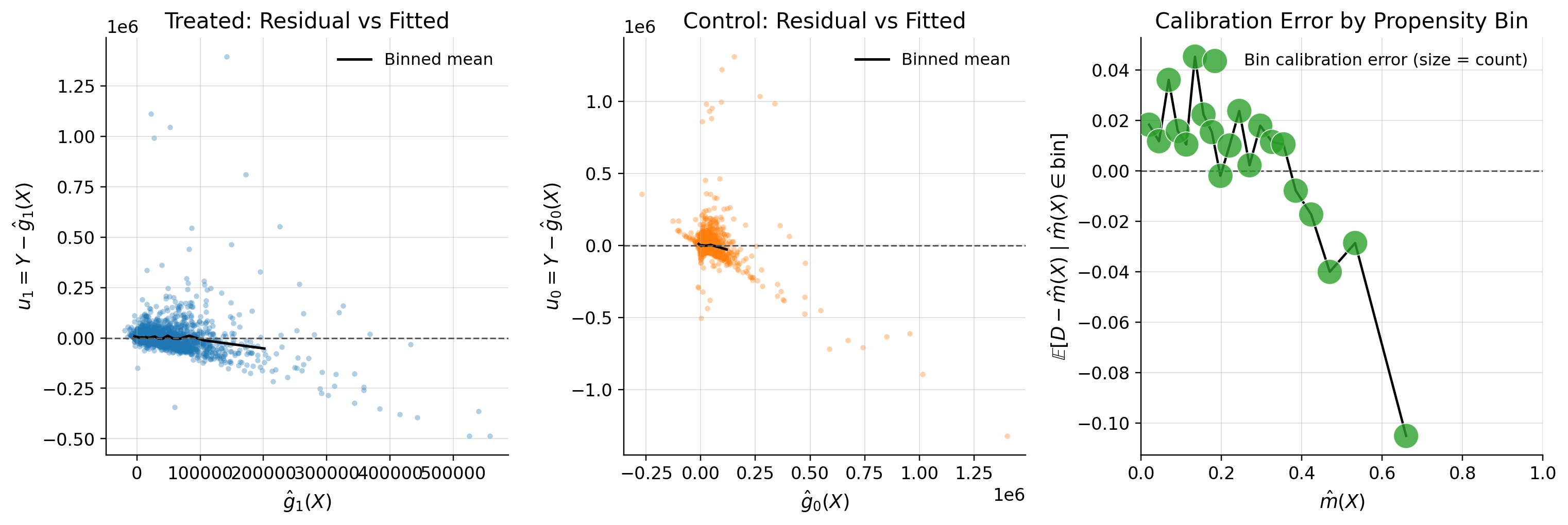

Overlap

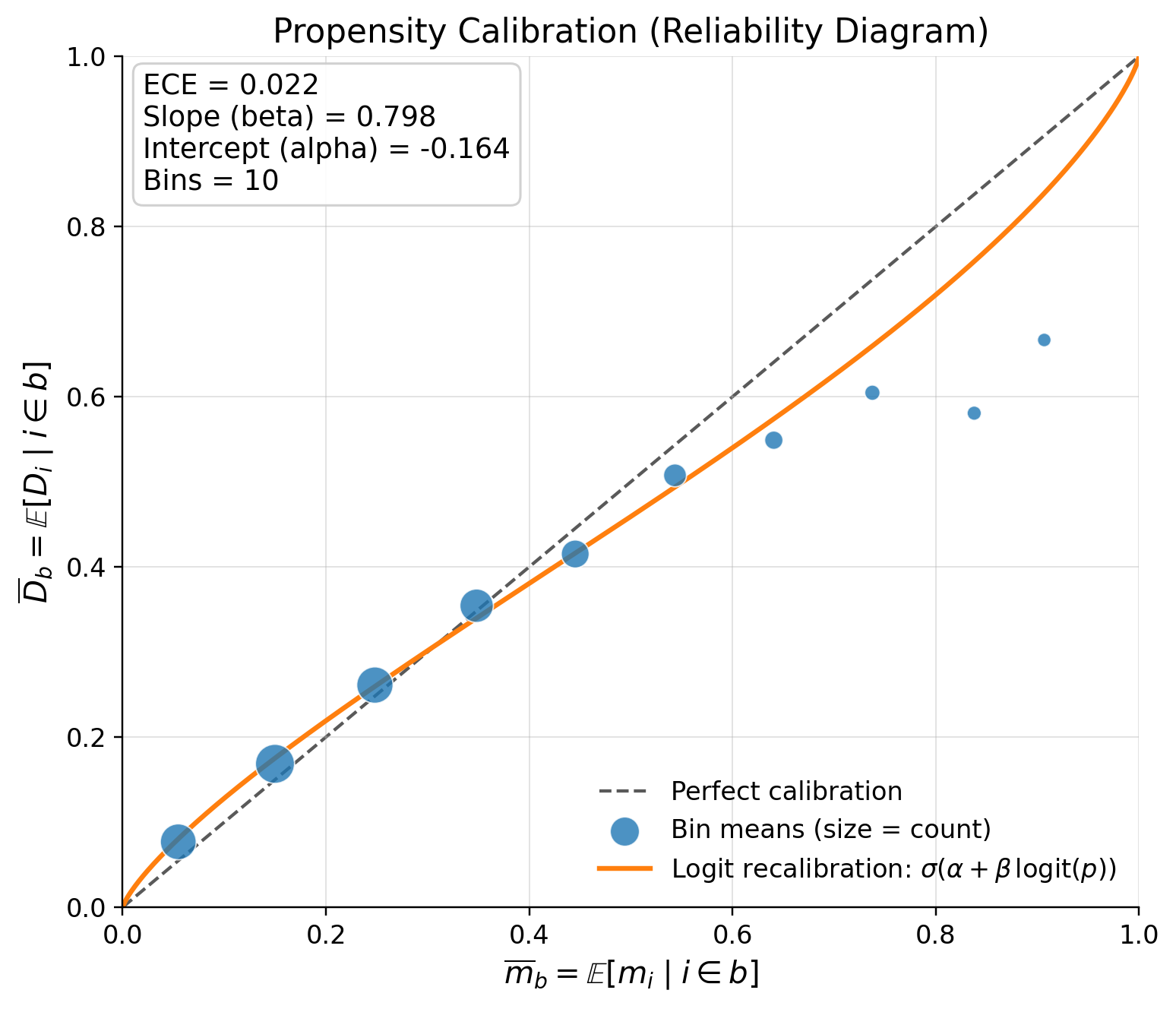

| metric | value | flag | |

|---|---|---|---|

| 0 | edge_0.01_below | 0.008472 | GREEN |

| 1 | edge_0.01_above | 0.000000 | GREEN |

| 2 | edge_0.02_below | 0.024307 | GREEN |

| 3 | edge_0.02_above | 0.000000 | GREEN |

| 4 | KS | 0.316022 | YELLOW |

| 5 | AUC | 0.711829 | GREEN |

| 6 | ESS_treated_ratio | 0.383340 | GREEN |

| 7 | ESS_control_ratio | 0.903632 | GREEN |

| 8 | tails_w1_q99/med | 7.777954 | YELLOW |

| 9 | tails_w0_q99/med | 2.375994 | GREEN |

| 10 | ATT_identity_relerr | 0.049028 | GREEN |

| 11 | clip_m_total | 0.008472 | GREEN |

| 12 | calib_ECE | 0.022127 | GREEN |

| 13 | calib_slope | 0.798318 | YELLOW |

| 14 | calib_intercept | -0.163574 | GREEN |

We find no evidence of a violation of the overlap (positivity) assumption.

Conclution

There are problems with design: confounders are measured not before treatment. So treatment affected confounders. However estimate is robust and in real life participation in 401k is increasing net financial assets. To keep in mind real CI bounds may differ from our estimation